Startups building IoT device hardware face many decisions. Choosing wireless protocols for consumer IoT devices is a big one. Weighing use cases and technical factors is important, but startups can live or die with market adoption of technology in a device. Poor choices can lead to failed products and crushing technical debt. Better choices win consumers and open new paths for innovation.

To help startups choose wisely, we begin 2020 with news before and at CES on consumer IoT wireless protocols. We’ve divided the field into four categories: mainstream, adjusting course, winding down, and the range rebels. We also look further ahead at one possibility that could shake up the mainstream.

In the mainstream

If there is such a thing as a sure thing for consumer IoT devices, these three technologies are it. Why are these in the mainstream? All come standard in every smartphone, the primary interface for personal IoT clusters. Each has many chipset suppliers. And, each has a strong specification body advancing its technology and ecosystem. Every consumer has touched these technologies – and watched them improve over time. Startups can jump right in on any of these technologies.

Bluetooth is expanding beyond a short range, point-to-point solution. Bluetooth Low Energy (BLE), range to hundreds of meters, and mesh capability were big steps. The Bluetooth SIG launched LE Audio at CES 2020 with two key features.

- Low Complexity Communication Codec improving compression and packet loss handling,

- Multi-Stream Audio to synchronized devices, with earbuds, speakers, and digital hearing aids in mind.

Wi-Fi already dominates in homes and businesses. The Wi-Fi Alliance is now pushing the envelope with core technology and spectrum upgrades. IEEE 802.11ax, aka Wi-Fi CERTIFIED 6 brings better radios for more throughput, lower latency, and more devices on each access point. The addition of Target Wake Time (TWT) stretches IoT device battery life. Wi-Fi 6E launched at CES 2020, targeting 5 GHz spectrum shortages by moving to 6GHz.

NFC owns the centimeter-range use case where phones tap to interact with IoT devices. The latest ideas from the NFC Forum are TNEP, the Tag NFC Data Exchange Format Exchange Protocol, and the Connection Handover Technical Specification CH 1.5. TNEP sets up bidirectional communication with IoT devices, while CH 1.5 uses TNEP for negotiated handover from NFC tags to Bluetooth or Wi-Fi. Specification updates at CES 2020 help error recovery and time optimized TNEP performance.

Adjusting course

Can a consumer IoT wireless protocol that’s not native in a smartphone succeed? Several competing mesh networking technologies already connect billions of microcontroller-based IoT devices. These technologies have more than a foothold in home automation. But, along with BLE and Wi-Fi they often compete for some of the same use cases, limiting their potential. Two major developments are realigning these ecosystems. One opens a specification, while the other integrates popular technologies into one framework. Startups should be able to move forward confidently in these ecosystems.

Z-Wave has been a single-source wireless protocol specification, started by Zensys in 1999. Sigma Designs acquired Z-Wave in 2008, then Silicon Labs acquired it again in 2018. Many developers see single-source as a risk in today’s open sourcing culture – and Silicon Labs gets it. They are opening the Z-Wave Specification, and setting up the Z-Wave Alliance as a standards-development organization. More silicon and software stack suppliers could spur innovation and speed up adoption.

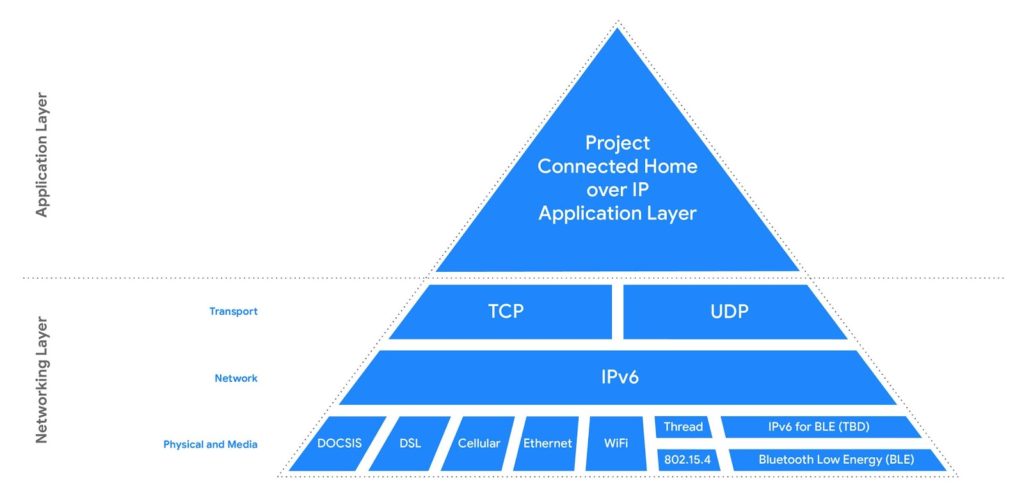

Project Connected Home over IP is backed by Amazon, Apple, Google, and the Zigbee Alliance. It should thrill IoT purists, endorsing IP-addressable IoT devices for easier cloud and cellular device connections. Wi-Fi and Thread are IP based, while BLE isn’t. Project Connected Home over IP brings Wi-Fi, Thread, and BLE into one open application layer, with the addition of an IPv6 for BLE block. The wildcard here is Thread, supported with chipsets from Cascoda, Nordic Semiconductor, NXP, Qualcomm, Silicon Labs, Texas Instruments, and others. It also could give Amazon and Apple developers better integration options.

image courtesy Google

Zigbee, as a protocol, is still popular in homes as well. But the Zigbee Alliance is betting heavily on interoperability between Thread Mesh and the Zigbee application layer using Dotdot, its contribution to Project Connected Home over IP. It’s a signal that the Zigbee protocol may continue in industrial IoT use cases like street lighting and smart metering, while Thread is the future for IP-based transport in home automation.

Winding down

Being early to the game is often a good thing. Yet, it’s hard to keep innovation going against bigger, better-funded forces who improve year after year. These wireless protocols had a great run – and still ship in significant volumes. Moving forward, their use cases have been overrun by other technologies we’ve discussed. Startups should avoid these technologies in most cases.

ANT+ debuted in 2004 with a ‘personal area network’ for ultra-low power sensors in fitness applications. Garmin stepped in, buying Dynastream and its ANT+ technology in 2006. There was a flash of hope in 2011 when Sony Mobile signed on and added support for ANT+ in its Xperia smartphones. But, the introduction of BLE in 2010 eroded the lock ANT+ enjoyed. Today many fitness devices ship with both BLE and ANT+ for backward compatibility or are BLE only. ANT+ has been quiet for two years, with only Nordic Semiconductor and Texas Instruments still providing chipsets.

Insteon launched in 2005 with a technological lead. Its main features included an unlimited size mesh, peer-to-peer connections, and automatic enrollment. It even bridged the X10 community in using powerline connections. But in the last two years, its momentum has stalled after an acquisition and new management. Their last major announcement was an ill-conceived Insteon Hub Pro with Apple HomeKit capability. Even with loyal Insteon customers still out there, holding its install base will be difficult.

The range rebels

There’s one frontier left on the consumer IoT: longer range. Bluetooth can tweak antennas and transmission power to get near a kilometer. LoRaWAN, eMTC (in the form of LTE-M), and NB-IoT provide kilometers of range for the industrial IoT today – more on that shortly. This gap is inspiring new IoT wireless protocols from three consumer ecosystems. One of these ‘range rebels’ has been on the market for several years. The other two are either still in the lab or just reaching early adopters. Startups should track developments here if range is a concern.

DECT ULE stands for Ultra Low Energy, a specification launched in 2013 by ETSI and promoted by the ULE Alliance. The DECT protocol is already in many homes with cordless phones, especially in Europe. DECT ULE uses the same physical layer with a new transport layer, supporting voice and video and home automation control. It runs in the 1.9 GHz radio band with a range of 50m indoor and 300m outdoor. ULE chipsets are available from Dialog Semiconductor and DSP Group. US audiences may have noticed DECT ULE at CES 2020 in the ADT Blue HD Smart Camera.

Wi-Fi HaLow has devices complying with the IEEE 802.11ah specification launched in 2017. It uses narrower channels on a 900 MHz radio band for about 10x longer range and better structure penetration than conventional Wi-Fi. Added sleep modes and listen-before-talk access help IoT devices conserve battery power. Chipsets are in development from startups including Adapt-IP, Morse Micro, Newratek, and Palma Ceia Semidesign.

Sidewalk is an Amazon effort previewed in September 2019. It targets space beyond the front door, covering mailboxes, lighting, watering, pet sensors, and more. It also uses 900 MHz spectrum to achieve up to a kilometer range. It’s a key part of Amazon’s vision for Ring devices using what they call a ‘neighbor-created network’ – presumably a mesh. Amazon has its own chip development capability. Their LinkedIn job post for a Sidewalk product manager shows they are still working on network specifications.

Looking further ahead

The consumer IoT wireless protocols in our mainstream and ‘adjusting course’ categories are ones to consider if a design started today. That decision could easily drive three or four lifecycles on a product roadmap. Looking a bit further ahead, one of these specifications is at risk of being overrun by an industry giant.

5G has enormous momentum and is being touted as the solution to practically everything for consumer device needs. Some are questioning how Wi-Fi fares versus 5G in the future. There’s precedent for this thinking: 4G LTE momentum overwhelmed WiMAX outside of a few niches. Realistically, it will be hard for competition to displace Wi-Fi routers from homes any time soon. While configuring Wi-Fi devices in a home isn’t simple, it is simple enough.

But the consumer IoT goes beyond homes. Personal clusters extend wherever a consumer takes their smartphone. Speed and spectrum availability may spawn captive 5G networks in businesses, on campuses, and across municipalities. Smartphones entering these zones would connect like roaming across commercial networks today.

There’s also continued development of cellular IoT specifications, already rolling out on 4G networks today. 3GPP Release 16 targeted for June 2020 is working toward 5G New Radio (NR) offering in-band deployment of eMTC and NB-IoT. This simplifies infrastructure and lets mobile network operators grab more IoT business.

Network coverage is one thing. Shifting consumers from Wi-Fi devices to cellular IoT devices means changing the network subscription model. Today, consumers pay the price for being high-volume multimedia data consumers. The model isn’t set up for most IoT devices that send a little bit of data every so often. If low-data-rate cellular contracts become widely available, the outlook for Wi-Fi could change. Consumer IoT device makers could become virtual mobile network operators if they achieve broader adoption. They could then bundle network access costs with their service.

Choose your consumer IoT protocols boldly

Consumers only have two questions about an IoT device: does it do what I want, and can I get it connected easily? It’s up to startups to choose wireless protocols for consumer IoT devices, then create powerful experiences around them.

At this point, no one is looking for consolidation of consumer IoT wireless protocols into a couple of contenders. Many wireless protocols exist spanning the variety of use cases. As new use cases develop, we continue seeing new efforts to better handle those.

Of course, your mileage may vary in choosing wireless protocols for consumer IoT devices. Without considering your use case and technical factors, it’s hard to judge a choice. If you can make a mainstream choice work, broader consumer adoption is more likely. But innovative approaches can work with any wireless protocol outside of our ‘winding down’ category.

Choose boldly. What are your thoughts about the outlook for wireless protocols in our ‘adjusting course’ and ‘range rebel’ categories?